Are Diamonds Jewellery A Good Investment? Sparkling Insights and Shimmering Truths

The glittering allure of diamonds, apart from adorning elegant necklines and fingers, often sparks a critical question: “is diamond a good investment”? Are these sparklers mere symbols of luxury, or do they promise a lucrative return? Let’s embark on a scintillating journey to uncover the facets of diamond investments.

2. Historical Value Retention of Diamonds

Dating back centuries, diamonds have been treasured not just for their beauty but also for their perceived value retention. While gold has its standardized value metrics, diamonds are assessed based on the 4 Cs – Carat, Clarity, Color, and Cut, making their value estimation a tad more complex.

3. The Resale Reality: Does Diamond Have Resale Value?

The pressing question, “does diamond have resale value”, comes with a multifaceted answer. Typically, high-quality diamonds tend to retain or even appreciate in value over extended periods. However, it’s crucial to note that immediate resale might not always fetch the purchase price, given the retail mark-ups.

Digging deep into the “diamond return value”, it’s imperative to differentiate between retail value and resale value. While retailers incorporate design, craftsmanship, and brand reputation into pricing, the resale often orbits around the intrinsic value of the gemstone.

The age-old economic principle of supply and demand profoundly influences the “diamond investment” landscape. Limited supply coupled with escalating demand, especially from burgeoning markets like China and India, can spur diamond values.

In today’s conscious consumerism era, the pedigree of a diamond matters. Ethically sourced diamonds, devoid of conflict shadows, are gaining momentum, subtly influencing their investment potential.

While lab-grown diamonds are making waves for their ethical and environmental standpoints, they don’t hold the same investment potential as their natural counterparts. Distinguishing between the two becomes paramount for genuine diamond investments.

8. Expert Tips: Making Diamonds Shine in Your Portfolio

If you’re pondering “are diamond a good investment”, engage with industry experts. Seeking certifications, understanding grading reports, and being aware of market trends can add that extra sparkle to your investment strategy.

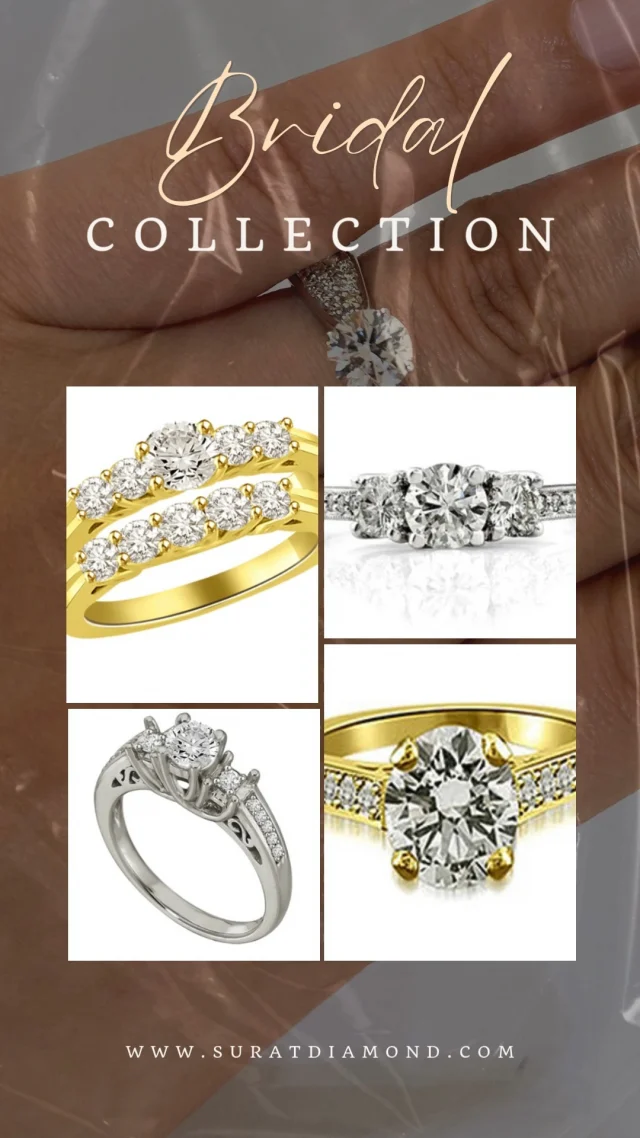

For those keen on specific diamond jewelry pieces, investing in timeless items like necklaces can be promising. Given their pronounced visibility and design complexity, necklaces often command attention and value.

Explore exquisite options at Surat Diamond Necklace Collection.

Conclusion: Deciphering the Diamond Riddle

To encapsulate, the diamond investment realm is shimmering with possibilities and pitfalls. While they offer a tangible, portable, and discreet form of wealth, understanding the nuances ensures that the investment doesn’t lose its shine. Knowledge, due diligence, and a sparkle of patience could potentially make diamonds a girl’s (and an investor’s) best friend.

Key Takeaways:

Diamond investments shimmer with potential but require meticulous understanding. Historical value retention and market dynamics significantly influence their investment feasibility. Resale values, though promising over long durations, might not always mirror purchase prices due to retail mark-ups. Ethical sourcing is pivotal in the modern diamond landscape, while synthetic diamonds, though ethically appealing, don’t match natural diamonds in investment terms. Strategic investment, backed by expertise and certifications, can truly make diamonds shine in an investment portfolio.

FAQs:

1. How do diamond investments compare to traditional assets like gold or stocks?

– Diamonds, unlike gold or stocks, don’t have a standardized valuation system, making their investment landscape more nuanced. However, with proper understanding, they can complement traditional assets.

2. Does the shape and size of the diamond influence its investment potential?

– Absolutely! While larger diamonds often command higher values, certain shapes, like the round brilliant, typically have a higher resale value.

3.How do global economic fluctuations impact diamond values?

– Economic downturns might see a reduced luxury spending affecting diamond prices. Conversely, economic booms could heighten demand and potentially boost diamond values.