Gold vs Silver: Which Is the Better Investment?

When you slip on a gold necklace or a silver bracelet, you’re doing more than accessorizing—you’re making a little investment decision. In India, where jewellery has always intersected with wealth, culture and legacy, the choice between gold investment and silver investment becomes especially meaningful.

But the question looms: which is the smarter move today—gold or silver? While gold has reigned for centuries, silver is gaining traction as a nimble, more accessible asset. The answer isn’t binary. It depends on your goals—whether you’re buying jewellery to wear and invest, or purely investing in bullion. Throughout this post, we’ll explore silver vs gold from multiple angles—cultural, financial, practical—so you can choose what aligns best with your needs and connect it to jewellery decisions you make at Surat Diamond.

Historical & Cultural Context of Gold & Silver

Gold – A Legacy of Value

Gold has been embedded in Indian culture for over 5,000 years. Archeological finds from the Indus Valley civilisation show gold ornaments and ritual items. In modern India, gold jewellery remains a key store of value, used for security, ceremonies, gifts and status.

Silver – The Under-appreciated Sibling

Silver has often played a secondary role—used in utensils, coins, smaller savings, but still deeply embedded in Indian households. More recently, silver is being looked at not only for jewellery but for investment purpose. For example, India is one of the largest physical silver investment markets.

This cultural backdrop matters because it shapes how people view gold investment vs silver investment—not just as commodities but as part of life and tradition.

The Financial Case – Gold Investment vs Silver Investment

Market Performance & Volatility

- Gold tends to be less volatile than silver. It is often called the safe-haven metal.

- Silver, meanwhile, while more volatile, offers potential higher percentage growth because of its lower entry cost and industrial demand.

- For example: In India, silver investment returned sharply in recent months—silver up ~21% vs gold ~5% in one three-month period.

Value & Entry Cost

- Gold has high monetary value per unit (gram or ounce) so entry cost is higher for small investors. (E.g., rural jewellery budgets often favour gold—but budget constraints matter.)

- Silver is more affordable per unit; this makes silver investment more accessible, especially for younger or smaller investors.

Role of Demand & Supply

- Gold demand in India remains massive, driven by jewellery consumption, investment, weddings and festivals.

- Silver’s appeal is dual: as investment AND industrial metal (electronics, solar, manufacturing). This introduces unique demand dynamics and some extra growth potential.

The Gold-Silver Ratio

- The gold-silver ratio (how many ounces of silver equal one ounce of gold) is often used by investors to judge relative value.

- When the ratio is very high, some analysts believe silver may be undervalued relative to gold, signalling buying opportunity in silver.

Jewellery Investment – The Hybrid Angle

Many buyers of gold or silver in India are buying jewellery—not just bullion. That adds extra dimensions: making charges, design value, wearability, resale, cultural value.

Gold Jewellery as Investment

- When you buy gold jewellery, you effectively get both adornment and asset. But making charges, design premiums and the jewellery piece’s condition affect resale value.

- From an investment perspective, simple designs (plain gold chains, necklaces) tend to maintain value better than ultra-ornate craft that may be out of fashion.

- If your primary aim is “investment + wear,” choosing clean, classic pieces from reputable jewellers (such as Surat Diamond) helps you hold value and use them.

Silver Jewellery as Investment

- Silver jewellery offers lower entry cost. You can buy meaningful silver chains or bracelets that you will also wear—unlocking utility and investment.

- But note: silver jewellery’s resale/wear value may suffer more than gold, because cultural preference for gold remains dominant; silver may have higher wear and tear.

- For those buying silver as a pure investment, consider bullion rather than heavily crafted jewellery, unless you truly love the piece and will wear it for decades.

Jewellery vs Bullion – Know Your Goal

- Goal A: Wear every day + investment → choose jewellery in gold or silver, but lean gold if value-preservation is priority.

- Goal B: Pure investment (minimal wear) → bullion bars/coins or ETFs might be better; silver may offer more upside but more risk.

- Goal C: Gift + investment (cultural context) → gold still holds strong across India for weddings, anniversaries; silver has niche appeal and cost advantage.

Silver vs Gold – Which Should You Choose?

Here’s a structured decision-framework to help you decide.

Consider Your Budget & Entry Point

If you have high budget and are focusing on long-term preservation and cultural value → gold investment makes sense. If you are younger, starting out, want a more affordable entry → silver investment gives access and potential for upside.

Consider Your Investment Time Horizon

- Long-term (10+ years): Gold’s track record as value store is strong.

- Medium/Short-term (3-7 years): Silver may offer higher growth potential (but higher volatility)

Consider Your Risk Profile

- Conservative investor (fear of loss, want stability): lean gold.

- Growth-oriented investor (can handle ups & downs): silver might add spice.

Consider Usage & Wearability

If you’re buying jewellery that you’ll wear—gold is widely accepted culturally, easier resale, strong demand. If you buy silver jewellery, make sure you love it and will wear it—then it’s both accessory and asset.

Consider Market Conditions

Watch the gold-silver ratio: when it rises high, silver may be relatively undervalued. Also consider inflation rates, industrial demand for silver, import duties, tax/tariff regimes (especially in India).

Consider Portfolio Diversification

Many experts recommend holding both metals—not an either/or conflict. Gold for base stability, silver for leveraged growth. Diversified metal holdings can hedge market risks.

Jewellery Buyer’s Tips for Investment-Savvy Purchase

When you go to buy gold or silver jewellery at a store like Surat Diamond, or decide whether to buy bullion or jewellery, here are smart guidelines.

- Purity and Hallmarking: For gold, 24K or 22K? For silver, ensure sterling or 999 purity and hallmark.

- Minimal Making Charges (for investment pieces): The simpler the design, the better for value. Trendy or heavy craft adds cost but may reduce resale value.

- Wearability + Resale Consideration: Choose timeless designs you can use; avoid styles that you might never wear again.

- Brand & Trust: Buy from trusted sources (Reputed jewellery houses, certified bullion sellers).

- Storage & Maintenance: Jewellery needs storage, protection, insurance; bullion too. Silver often requires more maintenance (tarnish etc).

- Tax, Duty & Import/Export Implications: Especially in India, import duty, state tax, GST etc impact actual cost.

- Exit Strategy: Understand how to liquidate—will you sell jewellery, melt it, sell the metal? For bullion, what are the costs?

- Document & Certification: Keep receipts, purity certificates. For silver bullion, know your storage options, authenticity verification.

- Emotional Factor – Wear What You Love: Investment aside, jewellery often connects emotionally. If you’re buying gold or silver jewellery because you love it, the “wear and joy” factor adds value.

Case Studies & Market Trends in India

Gold’s Resilience

Gold jewellery demand in India is enormous: Jewellery continues to dominate gold demand. ( For example, gold prices reached record highs in India in 2025, reflecting strong investor interest.

Silver’s Momentum

Silver investment is gaining traction. For example: India as one of the top physical silver investment markets. Trend data show silver’s value rising rapidly, sometimes outperforming gold in short bursts.

Historic Perspective

The gold-silver ratio is historically elevated: one ounce gold may buy many more ounces of silver than in past decades. This suggests silver may have relative upside if industrial demand or investor interest rises.

Jewellery Demand vs Investment Demand

In India, a large share of gold is bought for jewellery rather than pure investment, which matters in context of gold investment via jewellery purchases.

Jewellery & Investment—Bringing It All Together with Surat Diamond

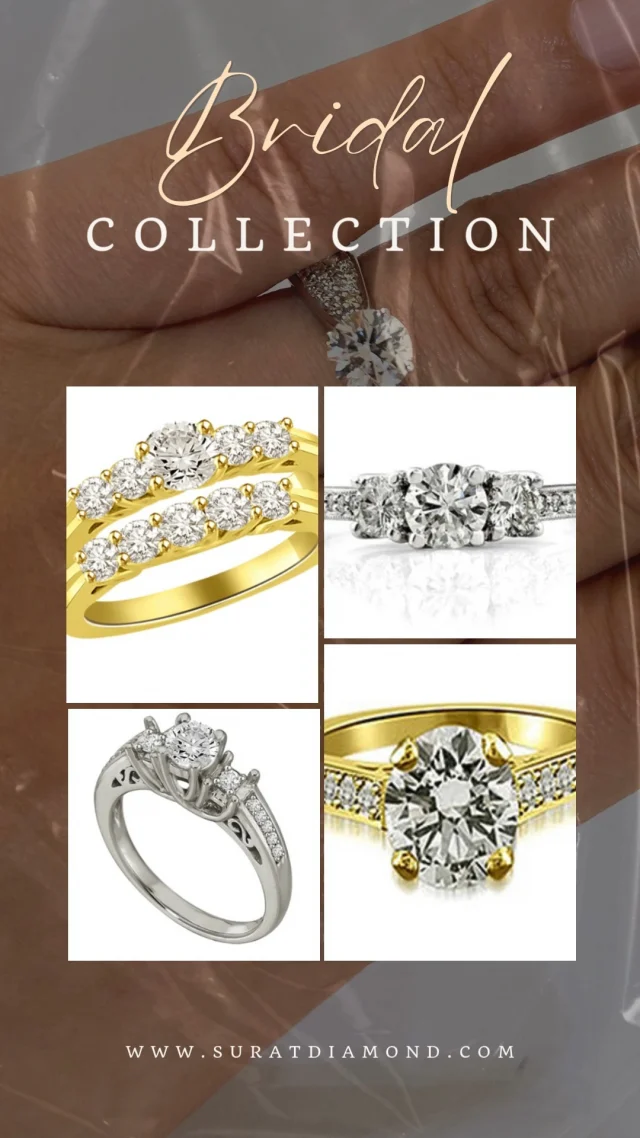

For those who buy gold or silver not just as investment but as jewellery that you’ll wear, SuratDiamond.com offers a compelling bridge between style and value.

- Gold Jewellery at Surat Diamond: Choose classic gold bracelets, chains, necklace sets designed for long-term wear and value. Every piece doubles as adornment and asset.

- Silver Jewellery at Surat Diamond: For budget savvy buyers, silver jewellery offers stylish access to metallic investment and wear-value. Combine silver pieces now and upgrade to gold as you scale.

- Mix & Match Strategy: A smart buyer might maintain a small collection of elegantly simple gold investment pieces + fun silver design pieces for everyday wear, thereby balancing both metal investment goals and lifestyle usage.

- Brand Trust & Certifications: This is critical when you’re using your jewellery as an investment. Surat Diamond emphasises clarity, purity and trustworthiness.

If your goal is to buy jewellery you’ll adore and keep—and have investment value too—Surat Diamond is a platform that supports both sides of the coin: beauty and value.

Conclusion

In the debate of silver vs gold, there’s no one-size-fits-all winner. Instead, there’s a winner for you—depending on your goals, budget, risk appetite and how you intend to use your purchase.

If you seek safe, culture-anchored value, gold investment is the foundation. If you are price-sensitive, growth-minded and willing to accept volatility, silver investment offers more access and upside. And if you’re buying jewellery, think about wear-value + investment-value together.

At SuratDiamond.com, you can explore jewellery options that combine both investment sensibility and aesthetic appeal. Browse gold and silver collections, ask questions about purity and resale, and build a jewellery-investment plan that reflects your life, your goals, and your style.

Start today: Identify your goal (wear vs invest), pick your metal mix (gold and/or silver), choose your pieces and make your move—confidently.

Key Takeaways

- The debate of silver vs gold isn’t simply about price—it’s about purpose, time-horizon, risk tolerance and culture.

- Gold investment offers stability, cultural resonance, strong resale demand, and has long served as a hedge against inflation.

- Silver investment provides accessibility, growth potential (especially due to industrial demand) but comes with higher volatility.

- Jewellery buyers should factor in design, making charges, wear-ability and resale when buying gold or silver pieces—not just metal weight.

- The gold-silver ratio is a useful tool: a very high ratio may signal silver is relatively cheap compared to gold.

- Diversification across both metals and using jewellery as part of investment + lifestyle can be optimal—buy pieces you’ll wear, value you’ll keep.

- For style + substance, explore trusted jewellery collections at Surat Diamond, choosing gold or silver pieces aligned with your goals.

FAQs

1. Should I invest in gold or silver right now?

That depends on your goals. If you want long-term stability and cultural value, gold is strong. If you’re younger, want lower cost entry and can handle ups and downs, silver may offer higher growth potential.

2. How does jewellery purchase affect my investment ingoldor silver?

When you buy jewellery, factors like making charges, design premium, wear and resale value matter. For pure investment, simpler pieces or bullion may be better; but jewellery gives you wear-value too.

3. What’s the gold-silver ratio and why does it matter?

The gold-silver ratio measures how many ounces (or grams) of silver equal one ounce (or gram) of gold. A high ratio may indicate silver is undervalued relative to gold, which can inform investment decisions.

4. If buying jewellery for both style and investment, which metal should I pick?

Consider a mix: for timeless value go gold; for cost-effective style go silver. Or start with one metal and add the other later. Focus on designs you will wear and that hold resale value.

5. What external factors affect gold and silver prices?

Global economic conditions, inflation, currency trends, industrial demand (especially for silver), and cultural demand (especially for gold in India).

6. Why buy jewellery (from a site like Surat Diamond) rather than just bullion?

Jewellery combines utility (you can wear it), emotional value and investment value. Sites like Surat Diamond offer high standards, brand trust, and pieces designed for both aesthetics and lasting value